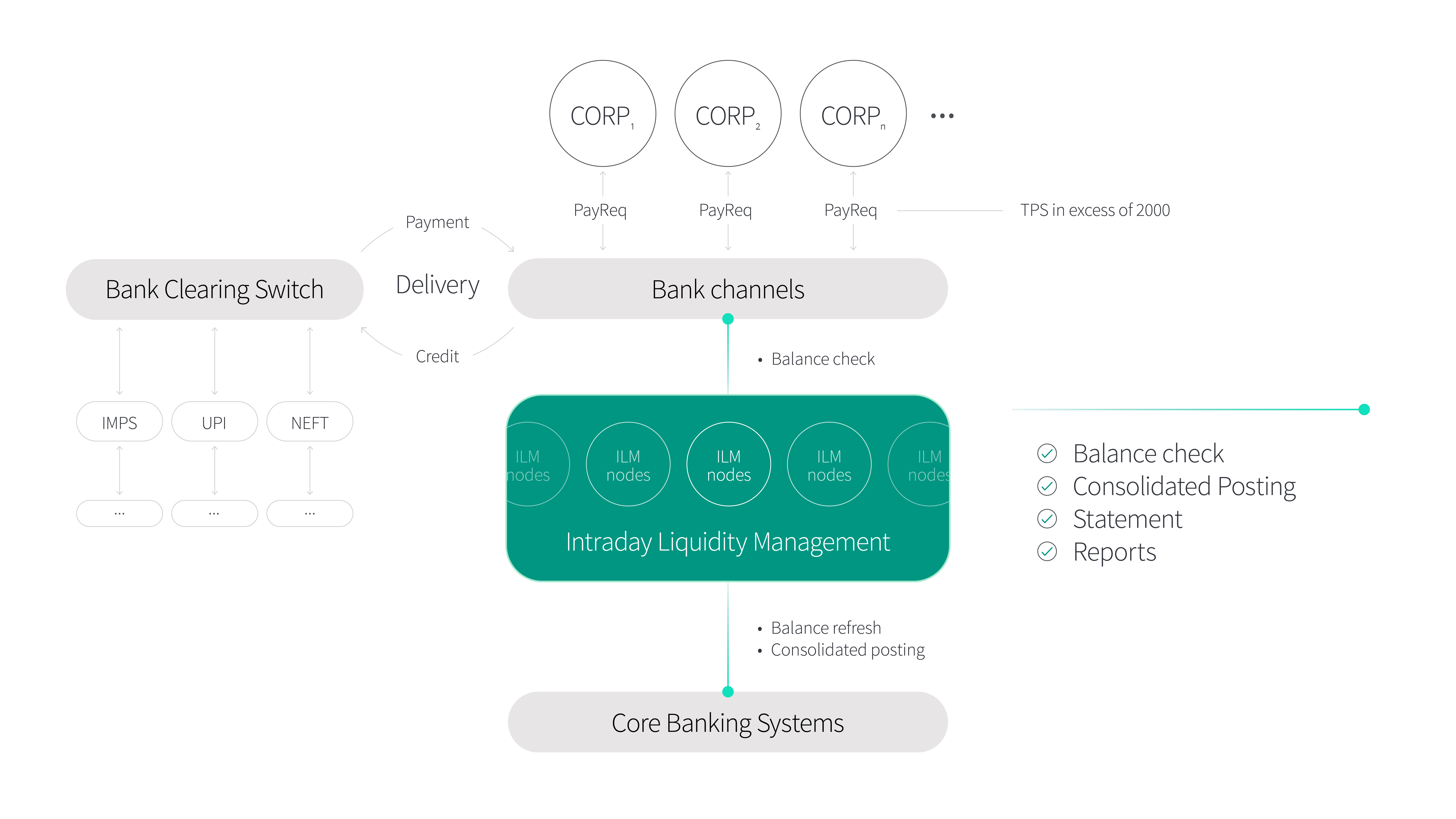

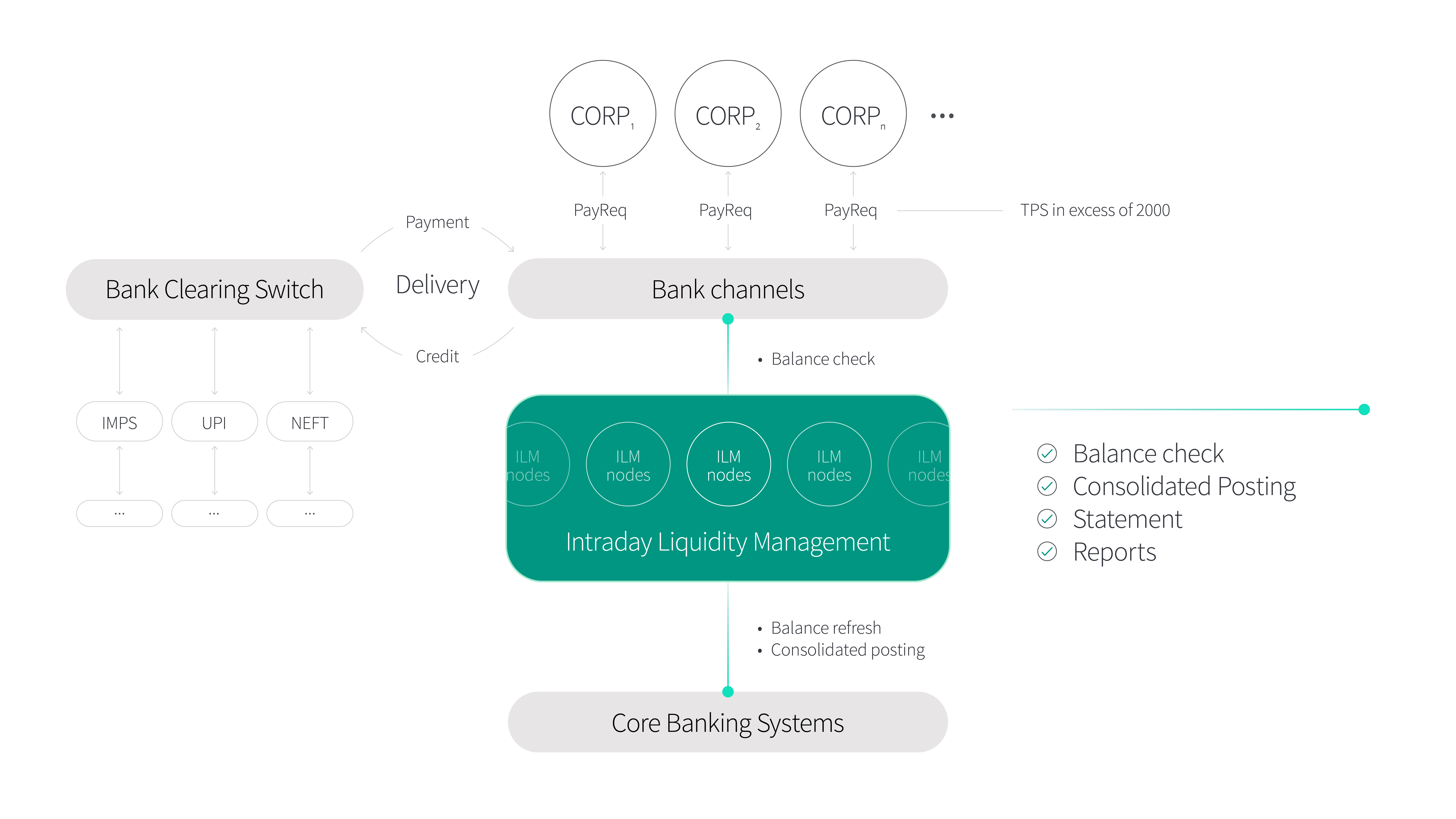

Montran’s Intraday Liquidity Management (ILM) is an innovative solution that strategically externalizes balance management for corporate accounts. This groundbreaking application relieves significantly, the core banking application of managing the high Transactions Per Second (TPS) posting requirements.

With the unprecedented growth of digital payments, banks’ Core Banking Systems (CBS) are overburdened with the processing of massive payment volumes in short time frames. These constraints result in account locking and transactions rejection issues.

The solution performs batchwise consolidated posting (time-based and amount-based configurations) with the CBS for corporate accounts. With availability of comprehensive statements and reports for corporate clients, the solution aids in streamlined reconciliation processes.

Montran’s ILM application has been implemented on Active-Active technology, which facilitates quicker and seamless payment processing for the bank’s corporate customers.

ILM receives real-time payment instructions from various payment channels of the bank, initiated by the bank’s corporate customers. The application fetches account balances from the bank’s CBS at regular intervals and maintains them in the system for transaction processing. ILM’s virtual accounting ledger feature ensures that the account balances are in synchronization with that of the CBS, thus facilitating liquidity monitoring and management at very high TPS. The balance limits are managed using Montran’s accounting space over distributed database technologies, which results in efficient and quick disbursement of payments via various payment rails such as, UPI, IMPS, NEFT and RTGS.

Montran’s ILM solution runs in an active-active multi-node deployment model facilitating quicker and seamless limit checking and subsequent payment processing functionalities.

Some of the key features of ILM are,

- 24×7 real-time liquidity monitoring and management of corporate transactions;

- Addressing CBS issues such as account locking and timeouts, by externalizing balance checking;

- High availability of the system with Active-Active Implementation;

- Real-time account balance management, directly synchronized with the CBS;

- Accurate Dashboards and Reports for real-time reconciliation of corporate accounts.

The system has achieved an overall throughput of over 2000 TPS across concurrent corporate accounts, resulting in better scalability and accelerated Time-to-Market. The solution’s robust infrastructure is designed to process daily transaction volumes over 10 million, providing unmatched performance and reliability for business operations. This in-turn enables streamlined workflows, fostering a more agile operational environment.

In addition, the Admin portal facilitates user action for transactions where manual intervention is required. Comprehensive dashboards and reports enable efficient reconciliation and accurate financial reporting.

With its innovative approach and robust infrastructure, the ILM solution redefines liquidity management for corporate transactions, fostering growth and business reliability.

.